FIRE: It's red hot

- frugal.zoomer

- Jun 23, 2020

- 2 min read

Updated: Jun 7, 2023

FIRE is a fun acronym that stands for Financial Independence, Retire Early.

I already wrote this post about early retirement, so you might be asking why the topic merits more discussion.

Well, FIRE actually means a lot more than retiring early. The core principles are the same (lower your expenses, raise your income, and save like crazy!) but FIRE is much bigger. It's an entire movement, a thought-experiment, a way of life, maybe even a cult.

FIRE is about accepting responsibility for your own life and realizing that time is ALWAYS more important than money. That's why you most likely wouldn't trade places with a 93 year old billionaire, if you had the choice. Financial independence means having enough money to live the life you've always dreamed of, and nothing more. Do you want to start a family? Write a book? Backpack through Europe for a year or ten? Is that dream more or less important than living in a mansion or owning a Corvette?

This movement forces you to take a good look at your spending and reckon with the choices you make on a daily basis. A $5 coffee once a day is $1,825 over the course of a year. If you invested your coffee money every year for ten years and got a standard 7% return, you would have $25,215 at the end. In 30 years, it would be a whopping $172,390.

Is a daily coffee worth 1/5 of your retirement savings goal?

Personally, yes.

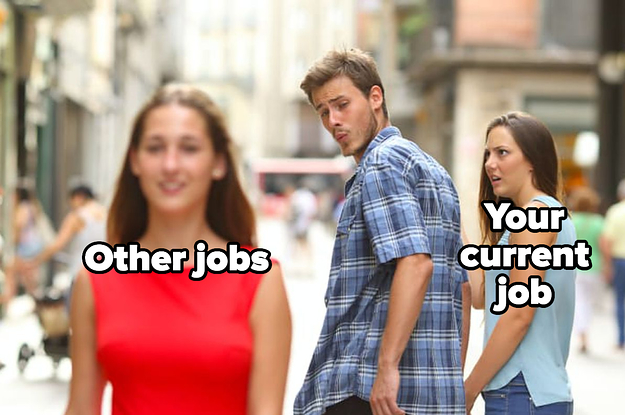

Still, FIRE means I confront the consequences of my spending decisions regularly and cut out the excess spending -- the investment gains I can't stand losing.

The idea of spending $50,000 instead of $5,000 every 10 years on a new car pains me. Personally, that $45,000 difference over 10 years (which, if invested, adds up to $425,100 over 30 years) isn't worth it.

That decision is completely up to you, even with FIRE. FIRE helps you shape your life in the present and the future so that you're able to be your happiest. It isn't meant to restrict your freedoms or make you miserable, but rather to let you know that there are always options.

As a word of warning, I just started implementing the FIRE method a few months ago. Every part of it appeals to me but I still have my doubts.

I've noticed that FIRE bloggers, authors, and experts tend to be...

White

Men

Without debt

With high-paying jobs - typically software engineers

Millennials who started investing during or around the 2008 stock market crash

These are privileges that make me wonder if FIRE is possible or approachable for the other 95% of the world.

I am two of those five things (I'll let you guess which) but I hope to give some positive news to all the non-white non-men debt-filled low-income zoomers over the coming years.

And unlike most financial independence bloggers, I didn't start my blog at the end of my success story to brag about my millions...

I'm starting it now so you can follow along and judge the FIRE concepts yourself!

If you want to read about someone a little further along their financial independence path, check out my Resources page to find some success stories.

What does financial independence look like to you? Does FIRE make sense for you?

Comments